The Social Security Organization (SOCSO) was set up in 1971 to implement, administer and enforce the Employees’ Social Security Act, 1969 and the Employees’ Social Security (General) Regulations, 1971. SOCSO gives protection which covers medical care, cash benefits, provision of artificial aids, rehabilitation programmes, and many others.

EMPLOYER’S LIABILITY

The principal and immediate employer who employs one or more employees is required to register and contribute monthly to SOCSO for all employees under the Employee’s Social Security Act, 1969.

The principal employer is also liable to ensure all employees employed by the immediate employer have been registered and their contributions have been paid.

EMPLOYEE

Employees earning less than RM3,000 must compulsorily contribute to SOCSO. SOCSO’s coverage is only applicable to employees who are Malaysian citizens and Permanent Residents. Employees earning more than RM3,000 and who had not previously registered or paid contributions to SOCSO are given an option to be covered under the Act. Employees who have been previously registered with SOCSO and now earn more than RM3,000 must compulsorily continue to contribute in line with the principle of “once in always in” under the First Schedule of the Act.

Categories of employees exempted from SOCSO’s coverage:

- Government employees

- Domestic servants

- Self-employed persons

- Foreign workers

- Business owner and spouses of sole-proprietorship or partnership

EMPLOYER REGISTRATION

Employers must register at the SOCSO office within 30 days from the date a worker is first employed. For registration, employers are to complete the following forms:-

A. Form 1 (Employer’s Registration Form) to be submitted with 2 copies of the following documents:

1. Private Limited Companies

- Form 9 (Companies Act, 1965)

- Form 49 (Companies Act, 1965)

2. Sole-proprietorship or partnership businesses

- Form D (Registration Certification)

- Form A (Business Certification)

or

3. Legal firms

- Legal Practicing Certification issued by the Bar Council

or

4. Private clinics

- Form 12 (Medical Practicing Certification – Approval from MMA)

or

5. Audit firms

- Companies Act 1965 – Auditors approval

or

6. Association/Society

- Form 3 (Regulation 5) Society Act 1966 (Regulation of Society 1984)

or

7. Others

- Documents as per required

B. Form 2 (Employee’s Registration Form)

The name and both the identity card numbers of an employee has to be written exactly as stated in the identity card.

DEFINITION OF WAGES

All remuneration payable in money to an employee is taken into account as wages for the purposes of SOCSO contributions. These include the following payments.:

- Salary

- Overtime payments

- Commission

- Payments for leave such as annual, sick and maternity leave, rest day, public holidays

- Allowances such as incentive, good behavior, cost of living allowance (COLA)

- Service Charge

However, the following payments are not considered as wages:

- Payments by employer to any pension or provident fund for employees

- Mileage claims

- Gratuity payment(s) for dismissal or retrenchments

- Annual bonus

(Note – The payments listed above are a few examples and are not comprehensive. If an employer needs further clarification pertaining to the definition of ‘wages’, please contact the nearest SOCSO office).

DUE DATE FOR CONTRIBUTION PAYMENT

Contribution for a certain month must be paid not later than the last day of the following month. For example, contribution for the month of April 2007 must be paid not later than 31st May 2007.

PENALTY

Under the Employee’s Social Security Act, 1969, an employer may be fined not more than RM10,000 or two years’ imprisonment or both if he is found guilty for the following offences:

- Default or delay in registering the business/company

- Default or delay in registering eligible employees

- Default or delay in paying monthly contributions

Forms and further information can be obtained by contacting the nearest SOCSO office or by logging on to www.perkeso.gov.my.

Source: PERKESO

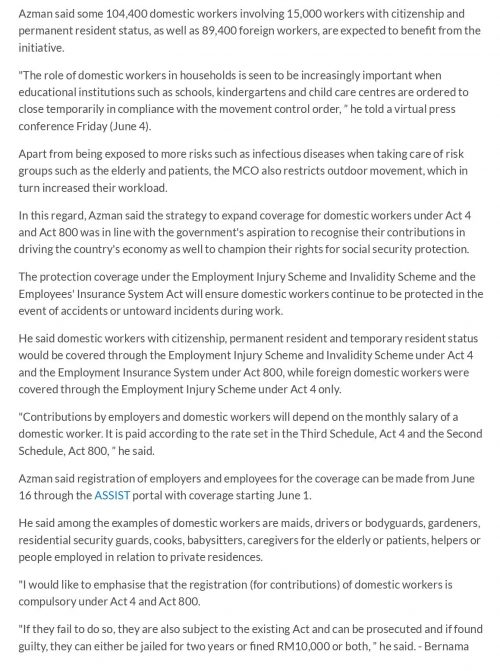

Source: The Star (4-6-2021) – Socso/Perkeso coverage extended to domestic workers from 1 June, 2021