Sales and Services Tax (SST)

Sales and Service Tax (“SST”) comprises sales tax and service tax.

Sales tax is a single-stage tax levied on all taxable goods manufactured and sold, used or disposed by a registered manufacturer in Malaysia or imported into Malaysia. Goods listed in the Sales Tax Exemption Order are exempt from sales tax. On the other hand, service tax is a single-stage tax charged on any taxable services provided in Malaysia by a registered person in carrying on business.

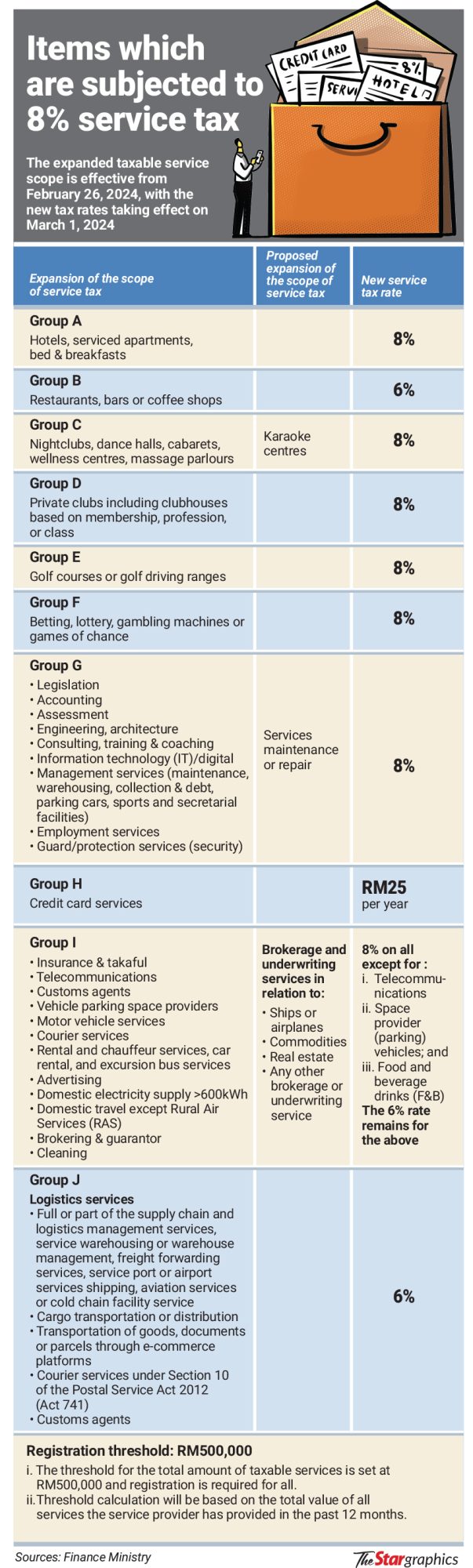

SST was implemented in Malaysia on 1st September, 2018. Goods will be taxed at 10%, while the provision of services will be taxed at 6%.

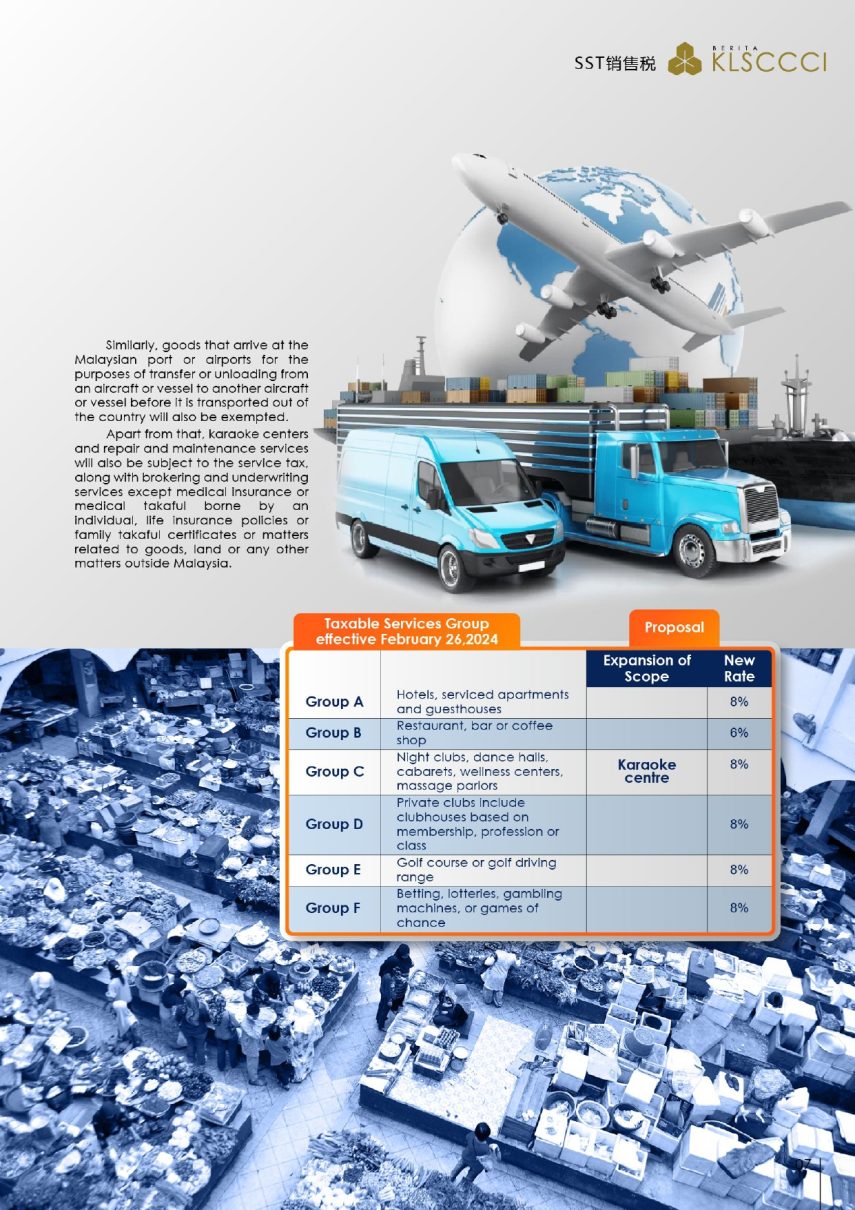

Effective from 1st March 2024, the rate of service tax under the Service Tax Act 2017 is increased from 6% to 8% on all taxable services excluding food & beverage services, telecommunication services, provision of parking spaces services and logistics services. Credit card and charge card services remain at a specific rate of RM25/year.

Kota Kinabalu branch

JKDM, Bahagian Cukai Dalam Negeri (CDN),

Aras Bawah & 1, Menara Kastam Sabah,

Jalan Ums, 88400

Kota Kinabalu, Sabah.

Tel: 088-348196/348213

Fax: 088-348255

Email: sto.sst@customs.gov.my

Official website of mySST: https://mysst.customs.gov.my/

Royal Malaysian Customs Department contact:

Source: The Star (1-3-2024) – SST scope graphic

Source: KLSCCCI e-Bulletin Issue 425 (03/2024)

Low Value Goods (LVG)

Low Value Goods (LVG) refers to all goods which are sold at a price not exceeding RM500 and are brought into Malaysia by land, sea or air.

Effective from 1st January, 2024, sellers from Malaysia or outside Malaysia who sell LVG are required to be registered and charge sales tax with a flat rate of 10%. Through this implementation sales tax will apply to LVG, sold online by seller and delivered to consumers in Malaysia via land, sea or air mode.

- “Seller” means a person, whether in or outside Malaysia, who sells LVG on an online platform or operates an online marketplace for the sales and purchase of LVG. The total sales value of LVG brought into Malaysia by land, sea or air mode exceeds RM500,000 within 12 months

- Applicants can start applying to be registered from 1 January 2023 through https://lvgcore.customs.gov.my/register

- For further information: https://mylvg.customs.gov.my/Home

- Guidelines:

http://www.customs.gov.my/en/Download%20Announcement/Guidelines%20for%20The%20Implementation%20of%20Sales%20Tax%20On%20Low%20Value%20Goods%20(LVG)%20%203.11.2023.pdf - FAQ:

http://www.customs.gov.my/en/Download%20Announcement/3.%20FAQ%20-%20Implementation%20of%20Sales%20Tax%20on%20LVG%20as%20of%206.11.2023.pdf - Contact: 1-300-888-500

- Email: mylvg@customs.gov.my, lvg.perkastamanhq@customs.gov.my

e-Invoice

To support the growth of the digital economy, the Government intends to implement e-Invoice in stages in an effort to enhance the efficiency of Malaysia’s tax administration management.

The e-Invoice will enable near real-time validation and storage of transactions, catering to Business-to-Business (B2B), Business-to-Consumer (B2C) and Business-to-Government (B2G) transactions.

All individuals and legal entities are required to comply with e-Invoice requirement, including: Association; Body of persons; Branch; Business trust; Co-operative societies; Corporations; Limited liability partnership; Partnership; Property trust fund; Property trust; Real estate investment trust; Representative office and regional office; Trust body; and Unit trust.

The mandatory e-Invoice implementation timeline:

- Phase 1: 1 August 2024 – Taxpayers with an annual turnover or revenue of more than RM100 million

- Phase 2: 1 January 2025 – Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million

- Phase 3: 1 July 2025 – All other taxpayers

Any latest information & details please refer to official website: